Waste Industry Merger and Acquisition Activity Expected to Pick Up this Year

Date: January 30, 2020

Source: Waste Business Journal

Waste Industry Merger and Acquisition Activity Expected to Pick Up this Year

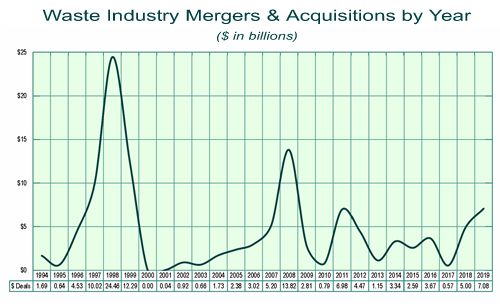

Waste industry merger and acquisition activity is expected to pick up this year, according to Waste Business Journal's recent Waste Market Overview & Outlook report. On the heals of recent deals including Waste Management's $4.9 billion proposed acquisition of Advanced Disposal and GFL Environmental's $2.8 billion purchase of Waste Industries last year, more deals are expected to follow in line with improving economy, increased cash-flow, business confidence, economies-of-scale, and tax law changes that put more capital in play.

Purchase the Waste Market Overview & Outlook 2019 (363 pages) for $995.

Already at play is up to $200 million in possible divestitures, as may be required by the Department of Justice, from the Waste Management/Advanced deal. Likely candidates for that include Waste Connections and GFL Environmental, which has recently raised capital to continue aggressive acquisitions.

Aside from the healthy economy, key factors driving further industry consolidation derive from the business being a capital intensive, highly regulated, recession resistant (80 percent of sales are service-based), essential service that generates ample cash flow and benefits from large economies-of-scale. This applies to efficiencies gained from operating larger collection fleets, to building bigger transfer and materials recovery facilities to operating larger landfills. Large landfills can be half as expensive to operate (on a per ton basis) than smaller ones but often require larger vertically-integrated collection and processing to feed them.

Another factor is diminishing landfill capacity in the Northeast. More waste exports drive the development of waste-by-rail systems and large destination landfills, both of which are capital intensive and require sophisticated organization. Witness Action Environmental (Interstate Waste)'s recent purchase of the Apex Landfill in Ohio and Macquarie Infrastructure's $590 million purchase of Tunnel Hill Partners, both of which are big waste-by-rail plays.

And there's room to grow. Non publicly-traded companies account for $17.5 billion (21 percent) of the $76 billion waste industry. Municipalities control another $14.4 billion. Among the private companies there has been a flurry of acquisitions. Those include companies to look out for like GFL, Meridian Waste, Rumpke, WCA Waste, Winters Bros. and others. It also stands to reason that more municipalities will continue to privatize or contract out waste services, particularly considering the recent challenges posed by recycling.

The Waste Market Overview & Outlook analyzes these trends and examines the long history of waste industry M&A to better understand the factors expected to accelerate future consolidation.

The Waste

Market Overview & Outlook details the $76 billion waste

management industry in the US. It examines the key components of the business

from collection, to materials processing and transfer stations, to ultimate

disposal in landfills or by waste-to-energy. It also examines the major

players from publicly-traded firms, private companies and municipalities

by understanding their operations, market share and interactions with

each other. Detailed data on waste generation, recovery, export, disposal,

pricing and remaining landfill capacity are provided by state, region

and nationally from 1992 on and projected through 2023.

The Waste

Market Overview & Outlook details the $76 billion waste

management industry in the US. It examines the key components of the business

from collection, to materials processing and transfer stations, to ultimate

disposal in landfills or by waste-to-energy. It also examines the major

players from publicly-traded firms, private companies and municipalities

by understanding their operations, market share and interactions with

each other. Detailed data on waste generation, recovery, export, disposal,

pricing and remaining landfill capacity are provided by state, region

and nationally from 1992 on and projected through 2023.

Other Segments and Waste Streams Covered:

- Construction and Demolition Debris Generation, Recovery and Disposal

- The growing problem of E-Waste, Legislation, Processors and Solutions

- Renewed focus on Organics and new Food Waste Programs

- Scrap Tires, Recycling and Conversion to Energy

- Waste Industry Equipment, Manufacturers and Segments

And much more…

Comprehensive Dataset Included

Included with this comprehensive and detailed 363-page report is an Excel dataset that includes historical and projected data on waste generation, recovery, exports, and disposal by landfill or WTE, remaining capacity and tipping fees for each major category of waste. The waste streams are broken out by MSW, organics, C&D, and industrial wastes. The statistics are aggregated by state, region and for the entire U.S.

To learn more about the Waste Market Overview & Outlook 2019 (363 pages), which costs $995 US, visit: www.wasteinfo.com/overview.htm. Or, call (619) 793-5190.

Sign up to receive our free Weekly News Bulletin