Marked Increase in Nonferrous Recyclables to China in 2023

Date: June 11, 2024

Source: U.S. Census Bureau

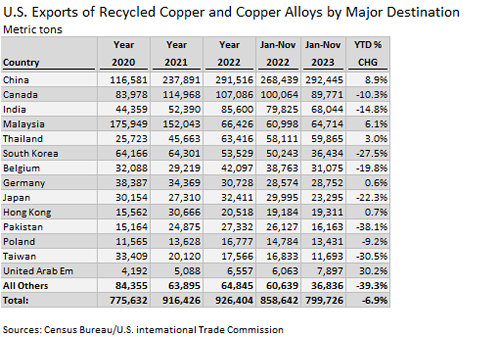

In 2023, the U.S. Census Bureau and U.S. Geological Survey data indicated a significant rise in copper-bearing scrap exports from the United States to the People's Republic of China, marking a nearly 12 percent increase from the previous year. This surge represented 350,000 metric tons of copper scrap shipped to China, comprising 19.5 percent of the total copper scrap collected in the U.S. and reflecting China's dominant position in this market. Other notable buyers of American copper scrap included India, Malaysia, Thailand, and South Korea.

Conversely, the aluminum scrap export market presented a different scenario, with only 33.6 percent of U.S.-generated aluminum scrap being exported in 2023. While China received a modest 10 percent of these exports, this still represented a substantial 39.5 percent increase from 2022. Leading buyers of U.S. aluminum scrap were India, Malaysia, South Korea, and Thailand, surpassing China's volume.

The ferrous scrap market in 2023 was characterized by a notable 9.2 percent decline in recycled steel exports from the U.S. compared to the previous year. While China significantly reduced its ferrous scrap imports, Turkey emerged as the dominant buyer, followed by Taiwan. Other major buyers such as Mexico, India, Bangladesh, and Malaysia experienced declines in their purchase levels.

Despite being a scrap surplus country, the U.S. imported considerable quantities of nonferrous and ferrous scrap, primarily from Canada and Mexico under the USMCA agreement. Imports of aluminum scrap reached 677,000 metric tons, copper scrap 119,000 metric tons, and ferrous scrap 5.13 million metric tons, with Canada and Mexico being the primary contributors.

On the whole, since the implementation of the National Sword Policy by the People's Republic, recyclable imports from the US have plummeted. The Chinese market for recyclable and (realistically) non-recyclable plastics has essentially completely dried up, and many US firms have been struggling to find customers ever since. Thus, this increase in Chinese demand for other recyclables marks a significant change in the trade relationship between the two countries.

These changing export rates for ferrous and nonferrous recyclables will have potentially major impacts on US domestic industries that rely on them. On one hand, firms that export nonferrous materials are happy to see a growing demand from China. These changes are likely to drive up prices for domestic manufacturers that rely on these materials.

Sign up to receive our free Weekly News Bulletin