WM Q3 Beats Analysts' Expectations

Date: November 2, 2020

Source: Waste Management, Inc.

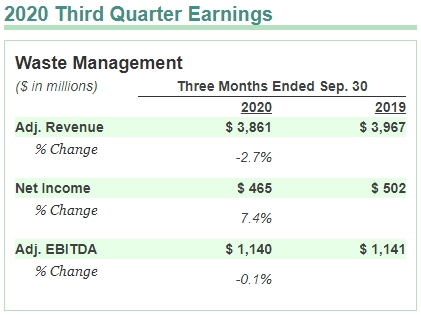

Waste Management surprised analysts with third quarter revenue and earnings that showed better-than-expected improvement in parallel with the gradual reopening of the economy. Earnings were $1.09 per share versus $1.19 per share a year ago, adjusted for non-recurring costs. Analysts had expected only $1.02 per share. Revenues for the quarter were $3.86 billion versus $3.97 billion a year ago, but also better than expected.

The company says that about 70% of commercial volumes affected by service suspensions or decreases have now come back, with landfill volumes down 4% as of September. Residential volumes remain above average but now by only single-digit percentages. CEO Jim Fish notes the company has learned lessons from the pandemic that will enable it to "emerge a stronger, more differentiated company" with lower costs as it reaps rewards of its technology investments.

Responding to a potential Biden win and the implied emphasis on the environment, Fish said "...regulation is actually in a strange way a good thing for us because we hold ourselves to a very high regulatory standard ...and so any additional regulation actually tends to work in our favor." He also said the company remains optimistic about the potential to get more than $100 million of synergies from integrating with recently acquired Advanced Disposal Services.

PRESS RELEASE

Waste Management Announces Third Quarter Earnings

Continued Strong Operating Performance Generates More Than

|

|

Three Months Ended |

Three Months Ended |

|||||||||

|

|

|

|

|||||||||

|

(in millions, except per share amounts) |

(in millions, except per share amounts) |

||||||||||

|

|

|||||||||||

|

|

As Reported |

|

As Adjusted(a) |

|

As Reported |

|

As Adjusted(a) |

||||

|

|

|

|

|

|

|

|

|

||||

|

Revenue |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||||

|

Income from Operations |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||||

|

Operating EBITDA(b) |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||||

|

Net Income(c) |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||||

|

Diluted EPS |

|

|

|

|

|

|

|

||||

"We've consistently pointed to operating EBITDA as the best measure of the health of our business, and despite the challenging backdrop, we delivered third quarter adjusted operating EBITDA results in line with last year's record performance and expanded adjusted operating EBITDA margin by 70 basis points," said

"In addition to our strong quarterly results, we are also proud to have published our 2020 Sustainability Report last month. Titled 'Building Value Together,' the report describes how we are addressing challenges and opportunities related to the environment, social issues and governance, and doing so in close partnership with our customers, suppliers and communities. Amidst the crises of 2020, we remained steadfast to our commitments of putting people first, advocating for inclusion and diversity, protecting the environment, and contributing to a circular economy."

Given the strength of the Company's third quarter, which demonstrated the resilience of the business model and strong execution on reducing the cost to serve, the Company expects to exceed its 2020 adjusted operating EBITDA margin guidance of 28.0% to 28.5% and generate free cash flow in excess of

KEY HIGHLIGHTS FOR THE THIRD QUARTER OF 2020

Revenue

- In the third quarter of 2020, revenue declined

$99 million in the Company's collection and disposal business compared to the third quarter of 2019, driven by$192 million in volume declines partially offset by$93 million of growth from yield. - Core price for the third quarter of 2020 was 3.2% compared to 4.0% in the third quarter of 2019 and 1.3% in the second quarter of 2020.(e)

- Collection and disposal yield was 2.6% in both the third quarter of 2020 and the third quarter of 2019 compared to 1.6% in the second quarter 2020.

Total Company volumes declined 5.0% in the third quarter of 2020, or 5.1% on a workday adjusted basis, compared to growth of 1.9% on a workday adjusted basis in the third quarter of 2019 and a decline of 10.3% in the second quarter of 2020.

Cost Management

- Operating expenses as a percentage of revenue improved 110 basis points to 60.4% when compared to the third quarter of 2019. The improvement was primarily driven by the Company's proactive management of costs, which reduced overtime hours and maintenance expenses. In addition, the Company's continued strategic focus on increasing the compressed natural gas composition of its fleet, combined with lower market prices for diesel fuel, resulted in lower operating costs and improved margins.

- SG&A expenses were 10.8% of revenue in the third quarter of 2020 compared to 9.7% in the third quarter of 2019. On an adjusted basis, SG&A expenses were 10.1% of revenue in the third quarter of 2020 compared to 9.7% in the third quarter of 2019.(a) The increase in SG&A expenses as a percent of revenue is primarily related to the decline in revenue as well as additional incentive compensation costs and the Company's intentional accelerated spending on technology.

Profitability

Total Company operating EBITDA was$1.10 billion , or 28.5% of revenue, for the third quarter of 2020. On an adjusted basis, total Company operating EBITDA was$1.14 billion , or 29.5% of revenue, for the third quarter of 2020 compared to adjusted operating EBITDA of$1.14 billion and 28.8% of revenue for the same period in 2019.(a)- Operating EBITDA in the Company's collection and disposal business, adjusted on the same basis as total Company operating EBITDA, was

$1.27 billion , or 31.2% of revenue, for the third quarter of 2020, compared to$1.30 billion , or 30.9% of revenue, for the third quarter of 2019.

Free Cash Flow & Capital Allocation

- In the third quarter of 2020, net cash provided by operating activities was

$1.03 billion compared to$952 million in the third quarter of 2019, an increase of$77 million , or 8.1%. - In the third quarter of 2020, capital expenditures were

$343 million compared to$483 million in the third quarter of 2019. - In the third quarter of 2020, free cash flow was

$691 million compared to$478 million in the third quarter of 2019.(a) - The Company paid

$230 million of dividends to shareholders.

Fish concluded, "We have taken to heart lessons learned during this pandemic such that we will emerge a stronger, more differentiated company. We've learned that we can operate our business with a lower cost structure, and we are holding on to operating efficiencies and cost savings as our volumes recover. Our customer service digitalization investments are unquestionably the right approach, and we have accelerated these efforts to reap the benefits sooner. With further contributions from the acquisition of Advanced Disposal that closed last week and our progress in transforming the recycling business, we are well positioned for a strong finish to the year with positive momentum heading into 2021."

|

(a) |

The information labeled "As Adjusted" in the table above, as well as adjusted operating EBITDA margin, adjusted SG&A expenses, and free cash flow are non-GAAP measures. Please see "Non-GAAP Financial Measures" below and the reconciliations in the accompanying schedules for more information. |

|

|

(b) |

Management defines operating EBITDA as GAAP income from operations before depreciation and amortization; this measure may not be comparable to similarly-titled measures reported by other companies. |

|

|

(c) |

For purposes of this press release, all references to "Net income" refer to the financial statement line item "Net income attributable to |

|

|

(d) |

The Company's 2020 guidance excludes (i) transaction and advisory costs incurred in connection with the acquisition of Advanced Disposal Services, Inc. and (ii) post-closing financial contributions related to the acquisition of Advanced Disposal Services, Inc, including divestiture proceeds. |

|

|

(e) |

Core price is a performance metric used by management to evaluate the effectiveness of our pricing strategies; it is not derived from our financial statements and may not be comparable to measures presented by other companies. Core price is based on certain historical assumptions, which may differ from actual results, to allow for comparability between reporting periods and to reveal trends in results over time. Beginning with the fourth quarter 2019, the Company has updated its core price calculation. With advancements in technology, the Company began collecting additional transactional customer level data, which provides improved clarity of the impact of the Company's pricing activities. While this does not change the year-over-year core price performance result, the new measure reflects a more precise calculation in the evaluation of revenue changes. |

The Company will host a conference call at

The conference call will be webcast live from the Investors section of Waste

Management's website www.wm.com.

To access the conference call by telephone, please dial (877) 710-6139 approximately

10 minutes prior to the scheduled start of the call. If you are calling from

outside of

A replay of the conference call will be available on the Company's website

www.wm.com

and by telephone from approximately

ABOUT WASTE MANAGEMENT

Waste Management, based in

FORWARD-LOOKING STATEMENTS

The Company, from time to time, provides estimates of financial and other data, comments on expectations relating to future periods and makes statements of opinion, view or belief about current and future events. This press release contains a number of such forward-looking statements, including but not limited to, all statements regarding 2020 free cash flow and operating EBITDA margin guidance; future performance or financial results of our business; responses and impacts of COVID-19; investments, cost structure, efficiencies and volumes; benefits from the acquisition of Advanced Disposal Services, Inc. ("Advanced Disposal") and results from our recycling business. You should view these statements with caution. They are based on the facts and circumstances known to the Company as of the date the statements are made. These forward-looking statements are subject to risks and uncertainties that could cause actual results to be materially different from those set forth in such

forward-looking statements, including but not limited to, increased competition; pricing actions; failure to implement our optimization, growth, and cost savings initiatives and overall business strategy; failure to identify acquisition targets and negotiate attractive terms; failure to consummate or integrate acquisitions; failure to obtain the results anticipated from acquisitions; failure to successfully integrate the acquisition of Advanced Disposal, realize anticipated synergies or obtain the results anticipated from such acquisition; environmental and other regulations, including developments related to emerging contaminants and renewable fuel; commodity price fluctuations; international trade restrictions; weakness in general economic conditions and capital markets; public health risk and other impacts of COVID-19 or similar pandemic conditions, including increased costs, social and commercial disruption, service reductions and other adverse effects on our business, financial condition, results of

operations and cash flows; failure to obtain and maintain necessary permits; disposal alternatives and waste diversion; declining waste volumes; failure to develop and protect new technology; failure of technology to perform as expected, including implementation of a new enterprise resource planning system; failure to prevent, detect and address cybersecurity incidents or comply with privacy regulations; significant environmental or other incidents resulting in liabilities and brand damage; significant storms and destructive events influenced by climate change; labor disruptions; impairment charges; and negative outcomes of litigation or governmental proceedings. Please also see the Company's filings with the

NON-GAAP FINANCIAL MEASURES

To supplement its financial information, the Company has presented, and/or may discuss on the conference call, adjusted earnings per diluted share, adjusted net income, adjusted income from operations, adjusted SG&A expenses, adjusted operating EBITDA, adjusted operating EBITDA margin, and free cash flow, as well as projections of adjusted operating EBITDA margin and free cash flow for 2020. These are non-GAAP financial measures, as defined in Regulation G of the Securities Exchange Act of 1934, as amended. The Company reports its financial results in compliance with GAAP but believes that also discussing non-GAAP measures provides investors with (i) financial measures the Company uses in the management of its business and (ii) additional, meaningful comparisons of current results to prior periods' results by excluding items that the Company does not believe reflect its fundamental business performance and are not representative or indicative of its results of operations.

The Company's non-GAAP results and projections exclude the impact of our acquisition of Advanced Disposal. In addition, the Company's projected full year 2020 adjusted operating EBITDA margin is anticipated to exclude the effects of other events or circumstances in 2020 that are not representative or indicative of the Company's results of operations. Such excluded items are not currently determinable, but may be significant, such as asset impairments and one-time items, charges, gains or losses from divestitures or litigation, and other items. Due to the uncertainty of the likelihood, amount and timing of any such items, the Company does not have information available to provide a quantitative reconciliation of such projection to the comparable GAAP measure.

The Company discusses free cash flow and provides a projection of free cash flow because the Company believes that it is indicative of its ability to pay its quarterly dividends, repurchase common stock, fund acquisitions and other investments and, in the absence of refinancings, to repay its debt obligations. Free cash flow is not intended to replace "Net cash provided by operating activities," which is the most comparable GAAP measure. The Company believes free cash flow gives investors useful insight into how the Company views its liquidity, but the use of free cash flow as a liquidity measure has material limitations because it excludes certain expenditures that are required or that the Company has committed to, such as declared dividend payments and debt service requirements. The Company defines free cash flow as net cash provided by operating activities, less capital expenditures, plus proceeds from divestitures of businesses and other assets (net of cash divested); this definition may not be comparable to similarly-titled measures reported by other companies.

The quantitative reconciliations of non-GAAP measures to the most comparable GAAP measures are included in the accompanying schedules, with the exception of projected adjusted operating EBITDA margin. Non-GAAP measures should not be considered a substitute for financial measures presented in accordance with GAAP.

|

|

||||||||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

||||||||||||

|

(In Millions, Except per Share Amounts) |

||||||||||||

|

(Unaudited) |

||||||||||||

|

|

|

Three Months Ended |

|

Nine Months Ended |

||||||||

|

|

|

|

|

|

||||||||

|

|

|

2020 |

|

2019 |

|

2020 |

|

2019 |

||||

|

Operating revenues |

|

$ |

3,861 |

|

$ |

3,967 |

|

$ |

11,151 |

|

$ |

11,609 |

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating |

|

|

2,332 |

|

|

2,441 |

|

|

6,841 |

|

|

7,182 |

|

Selling, general and administrative |

|

|

416 |

|

|

386 |

|

|

1,218 |

|

|

1,186 |

|

Depreciation and amortization |

|

|

419 |

|

|

404 |

|

|

1,235 |

|

|

1,179 |

|

Restructuring |

|

|

7 |

|

|

1 |

|

|

9 |

|

|

3 |

|

(Gain) loss from divestitures, asset impairments and unusual items, net |

|

|

7 |

|

|

1 |

|

|

68 |

|

|

8 |

|

|

|

|

3,181 |

|

|

3,233 |

|

|

9,371 |

|

|

9,558 |

|

Income from operations |

|

|

680 |

|

|

734 |

|

|

1,780 |

|

|

2,051 |

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

(97) |

|

|

(105) |

|

|

(328) |

|

|

(301) |

|

Loss on early extinguishment of debt |

|

|

(52) |

|

|

(1) |

|

|

(52) |

|

|

(85) |

|

Equity in net losses of unconsolidated entities |

|

|

(16) |

|

|

(14) |

|

|

(56) |

|

|

(39) |

|

Other, net |

|

|

1 |

|

|

1 |

|

|

2 |

|

|

(52) |

|

|

|

|

(164) |

|

|

(119) |

|

|

(434) |

|

|

(477) |

|

Income before income taxes |

|

|

516 |

|

|

615 |

|

|

1,346 |

|

|

1,574 |

|

Income tax expense |

|

|

126 |

|

|

120 |

|

|

288 |

|

|

350 |

|

Consolidated net income |

|

|

390 |

|

|

495 |

|

|

1,058 |

|

|

1,224 |

|

Less: Net income (loss) attributable to noncontrolling interests |

|

|

— |

|

|

— |

|

|

— |

|

|

1 |

|

Net income attributable to |

|

$ |

390 |

|

$ |

495 |

|

$ |

1,058 |

|

$ |

1,223 |

|

Basic earnings per common share |

|

$ |

0.92 |

|

$ |

1.17 |

|

$ |

2.50 |

|

$ |

2.88 |

|

Diluted earnings per common share |

|

$ |

0.92 |

|

$ |

1.16 |

|

$ |

2.49 |

|

$ |

2.86 |

|

Weighted average basic common shares outstanding |

|

|

422.7 |

|

|

424.5 |

|

|

423.1 |

|

|

424.6 |

|

Weighted average diluted common shares outstanding |

|

|

424.6 |

|

|

427.4 |

|

|

425.0 |

|

|

427.4 |

|

|

||||||

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

||||||

|

(In Millions) |

||||||

|

(Unaudited) |

||||||

|

|

|

|

|

|

||

|

|

|

2020 |

|

2019 |

||

|

ASSETS |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

703 |

|

$ |

3,561 |

|

Receivables, net |

|

|

2,217 |

|

|

2,319 |

|

Other |

|

|

437 |

|

|

329 |

|

Total current assets |

|

|

3,357 |

|

|

6,209 |

|

Property and equipment, net |

|

|

12,846 |

|

|

12,893 |

|

|

|

|

6,504 |

|

|

6,532 |

|

Other intangible assets, net |

|

|

450 |

|

|

521 |

|

Other |

|

|

1,615 |

|

|

1,588 |

|

Total assets |

|

$ |

24,772 |

|

$ |

27,743 |

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

Accounts payable, accrued liabilities and deferred revenues |

|

$ |

2,639 |

|

$ |

2,926 |

|

Current portion of long-term debt |

|

|

167 |

|

|

218 |

|

Total current liabilities |

|

|

2,806 |

|

|

3,144 |

|

Long-term debt, less current portion |

|

|

10,255 |

|

|

13,280 |

|

Other |

|

|

4,554 |

|

|

4,249 |

|

Total liabilities |

|

|

17,615 |

|

|

20,673 |

|

Equity: |

|

|

|

|

|

|

|

|

|

|

7,155 |

|

|

7,068 |

|

Noncontrolling interests |

|

|

2 |

|

|

2 |

|

Total equity |

|

|

7,157 |

|

|

7,070 |

|

Total liabilities and equity |

|

$ |

24,772 |

|

$ |

27,743 |

|

|

||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

||||||

|

(In Millions) |

||||||

|

(Unaudited) |

||||||

|

|

|

Nine Months Ended |

||||

|

|

|

|

||||

|

|

|

2020 |

|

2019 |

||

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

Consolidated net income |

|

$ |

1,058 |

|

$ |

1,224 |

|

Adjustments to reconcile consolidated net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

1,235 |

|

|

1,179 |

|

Loss on early extinguishment of debt |

|

|

52 |

|

|

85 |

|

Other |

|

|

364 |

|

|

289 |

|

Change in operating assets and liabilities, net of effects of acquisitions and divestitures |

|

|

(59) |

|

|

75 |

|

Net cash provided by operating activities |

|

|

2,650 |

|

|

2,852 |

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

Acquisitions of businesses, net of cash acquired |

|

|

(3) |

|

|

(513) |

|

Capital expenditures |

|

|

(1,238) |

|

|

(1,532) |

|

Proceeds from divestitures of businesses and other assets (net of cash divested) |

|

|

20 |

|

|

29 |

|

Other, net |

|

|

(20) |

|

|

(80) |

|

Net cash used in investing activities |

|

|

(1,241) |

|

|

(2,096) |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

New borrowings |

|

|

231 |

|

|

4,558 |

|

Debt repayments |

|

|

(3,942) |

|

|

(502) |

|

Premiums paid on early extinguishment of debt |

|

|

(30) |

|

|

(84) |

|

Net commercial paper borrowings (repayments) |

|

|

597 |

|

|

(1,001) |

|

Common stock repurchase program |

|

|

(402) |

|

|

(248) |

|

Cash dividends |

|

|

(696) |

|

|

(658) |

|

Exercise of common stock options |

|

|

49 |

|

|

60 |

|

Tax payments associated with equity-based compensation transactions |

|

|

(34) |

|

|

(32) |

|

Other, net |

|

|

(17) |

|

|

(13) |

|

Net cash (used in) provided by financing activities |

|

|

(4,244) |

|

|

2,080 |

|

Effect of exchange rate changes on cash, cash equivalents and restricted cash and cash equivalents |

|

|

1 |

|

|

1 |

|

(Decrease) increase in cash, cash equivalents and restricted cash and cash equivalents |

|

|

(2,834) |

|

|

2,837 |

|

Cash, cash equivalents and restricted cash and cash equivalents at beginning of period |

|

|

3,647 |

|

|

183 |

|

Cash, cash equivalents and restricted cash and cash equivalents at end of period |

|

$ |

813 |

|

$ |

3,020 |

|

|

||||||||||||

|

SUMMARY DATA SHEET |

||||||||||||

|

(In Millions) |

||||||||||||

|

(Unaudited) |

||||||||||||

|

Operating Revenues by Line of Business |

||||||||||||

|

|

|

Three Months Ended |

|

Nine Months Ended |

||||||||

|

|

|

|

|

|

||||||||

|

|

|

2020 |

|

2019 |

|

2020 |

|

2019 |

||||

|

Commercial |

|

$ |

1,025 |

|

$ |

1,069 |

|

$ |

3,016 |

|

$ |

3,147 |

|

Residential |

|

|

662 |

|

|

661 |

|

|

1,969 |

|

|

1,956 |

|

Industrial |

|

|

709 |

|

|

766 |

|

|

2,027 |

|

|

2,190 |

|

Other collection |

|

|

120 |

|

|

130 |

|

|

347 |

|

|

361 |

|

Total collection |

|

|

2,516 |

|

|

2,626 |

|

|

7,359 |

|

|

7,654 |

|

Landfill |

|

|

946 |

|

|

993 |

|

|

2,707 |

|

|

2,880 |

|

Transfer |

|

|

482 |

|

|

471 |

|

|

1,362 |

|

|

1,357 |

|

Recycling |

|

|

290 |

|

|

245 |

|

|

819 |

|

|

800 |

|

Other |

|

|

458 |

|

|

469 |

|

|

1,297 |

|

|

1,345 |

|

Intercompany (a) |

|

|

(831) |

|

|

(837) |

|

|

(2,393) |

|

|

(2,427) |

|

Total |

|

$ |

3,861 |

|

$ |

3,967 |

|

$ |

11,151 |

|

$ |

11,609 |

|

Internal Revenue Growth |

||||||||||||||||||||||||||||||||

|

|

Period-to-Period Change for the Three Months |

|

|

Period-to-Period Change for the Nine Months |

|

|||||||||||||||||||||||||||

|

|

|

|

|

As a % of |

|

|

|

|

|

As a % of |

|

|

|

|

|

As a % of |

|

|

|

|

|

As a % of |

|

|||||||||

|

|

|

|

|

Related |

|

|

|

|

|

Total |

|

|

|

|

|

Related |

|

|

|

|

|

Total |

|

|||||||||

|

|

Amount |

|

Business(b) |

|

|

Amount |

|

Company(c) |

|

|

Amount |

|

Business(b) |

|

|

Amount |

|

Company(c) |

|

|||||||||||||

|

Collection and disposal |

$ |

93 |

|

2.6 |

% |

|

|

|

|

|

|

|

$ |

220 |

|

2.1 |

% |

|

|

|

|

|

|

|||||||||

|

Recycling commodities (d) |

|

39 |

|

16.6 |

|

|

|

|

|

|

|

|

|

4 |

|

0.6 |

|

|

|

|

|

|

|

|||||||||

|

Fuel surcharges and mandated fees |

|

(42) |

|

(27.3) |

|

|

|

|

|

|

|

|

|

(118) |

|

(25.3) |

|

|

|

|

|

|

|

|||||||||

|

Total average yield (e) |

|

|

|

|

|

|

$ |

90 |

|

2.3 |

% |

|

|

|

|

|

|

|

$ |

106 |

|

0.9 |

% |

|||||||||

|

Volume |

|

|

|

|

|

|

|

(197) |

|

(5.0) |

|

|

|

|

|

|

|

|

|

(593) |

|

(5.1) |

|

|||||||||

|

Internal revenue growth |

|

|

|

|

|

|

|

(107) |

|

(2.7) |

|

|

|

|

|

|

|

|

|

(487) |

|

(4.2) |

|

|||||||||

|

Acquisitions |

|

|

|

|

|

|

|

4 |

|

— |

|

|

|

|

|

|

|

|

|

43 |

|

0.4 |

|

|||||||||

|

Divestitures |

|

|

|

|

|

|

|

(1) |

|

— |

|

|

|

|

|

|

|

|

|

(3) |

|

— |

|

|||||||||

|

Foreign currency translation |

|

|

|

|

|

|

|

(2) |

|

— |

|

|

|

|

|

|

|

|

|

(11) |

|

(0.1) |

|

|||||||||

|

Total |

|

|

|

|

|

|

$ |

(106) |

|

(2.7) |

% |

|

|

|

|

|

|

|

$ |

(458) |

|

(3.9) |

% |

|||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

Period-to-Period Change for the Three Months |

|

Period-to-Period Change for the Nine Months |

|||||||||||||||||||||||||||||

|

|

As a % of Related Business(b) |

|

As a % of Related Business(b) |

|||||||||||||||||||||||||||||

|

|

Yield |

Volume(f) |

|

Yield |

Volume(f) |

|||||||||||||||||||||||||||

|

Commercial |

3.4 |

% |

(5.7) |

% |

|

2.5 |

% |

(4.9) |

% |

|||||||||||||||||||||||

|

Industrial |

3.0 |

|

(9.4) |

|

|

2.5 |

|

(9.3) |

|

|||||||||||||||||||||||

|

Residential |

3.5 |

|

(2.9) |

|

|

2.6 |

|

(2.3) |

|

|||||||||||||||||||||||

|

Total collection |

3.2 |

|

(5.7) |

|

|

2.5 |

|

(5.2) |

|

|||||||||||||||||||||||

|

MSW |

1.9 |

|

0.1 |

|

|

2.3 |

|

(3.1) |

|

|||||||||||||||||||||||

|

Transfer |

3.6 |

|

1.4 |

|

|

3.0 |

|

(1.0) |

|

|||||||||||||||||||||||

|

Total collection and disposal |

2.6 |

% |

(5.5) |

% |

|

2.1 |

% |

(5.8) |

% |

|||||||||||||||||||||||

| _____________________________ | ||

|

(a) |

Intercompany revenues between lines of business are eliminated in the Condensed Consolidated Financial Statements included herein. |

|

|

(b) |

Calculated by dividing the increase or decrease for the current year period by the prior year period's related business revenue adjusted to exclude the impacts of divestitures for the current year period. |

|

|

(c) |

Calculated by dividing the increase or decrease for the current year period by the prior year period's total Company revenue adjusted to exclude the impacts of divestitures for the current year period. |

|

|

(d) |

Includes combined impact of commodity price variability and changes in fees. |

|

|

(e) |

The amounts reported herein represent the changes in our revenue attributable to average yield for the total Company. |

|

|

(f) |

Workday adjusted volume impact. |

|

| SUMMARY DATA SHEET | ||||||||||||

| (In Millions) | ||||||||||||

| (Unaudited) | ||||||||||||

| Free Cash Flow (a) | ||||||||||||

|

Three Months Ended |

Nine Months Ended |

|||||||||||

|

|

|

|||||||||||

|

2020 |

2019 |

2020 |

2019 |

|||||||||

| Net cash provided by operating activities |

$ |

1,029 |

$ |

952 |

$ |

2,650 |

$ |

2,852 |

||||

| Capital expenditures |

|

(343) |

|

(483) |

|

(1,238) |

|

(1,532) |

||||

| Proceeds from divestitures of businesses and other assets (net of cash divested) |

|

5 |

|

9 |

|

20 |

|

29 |

||||

| Free cash flow |

$ |

691 |

$ |

478 |

$ |

1,432 |

$ |

1,349 |

||||

|

Three Months Ended |

Nine Months Ended |

|||||||||||

|

|

|

|||||||||||

|

2020 |

2019 |

2020 |

2019 |

|||||||||

| Supplemental Data | ||||||||||||

| Internalization of waste, based on disposal costs |

|

68.4% |

|

66.4% |

|

68.4% |

|

66.4% |

||||

| Landfill amortizable tons (in millions) |

|

28.7 |

|

31.2 |

|

82.9 |

|

91.6 |

||||

| Acquisition Summary (b) | ||||||||||||

| Gross annualized revenue acquired |

|

1 |

|

51 |

|

3 |

|

170 |

||||

| Total consideration, net of cash acquired |

|

1 |

|

78 |

|

2 |

|

513 |

||||

| Cash paid for acquisitions consummated during the period, net of cash acquired |

|

1 |

|

71 |

|

2 |

|

504 |

||||

| Cash paid for acquisitions including contingent consideration and other items from prior periods, net of cash acquired |

|

1 |

|

76 |

|

4 |

|

518 |

||||

| Amortization, Accretion and Other Expenses for Landfills: |

Three Months Ended |

Nine Months Ended |

||||||||||

|

|

|

|||||||||||

|

2020 |

2019 |

2020 |

2019 |

|||||||||

| Landfill amortization expense: | ||||||||||||

| Cost basis of landfill assets |

$ |

120 |

$ |

129 |

$ |

345 |

$ |

372 |

||||

| Asset retirement costs |

|

28 |

|

23 |

|

89 |

|

68 |

||||

| Total landfill amortization expense |

|

148 |

|

152 |

|

434 |

|

440 |

||||

| Accretion and other related expense |

|

26 |

|

26 |

|

76 |

|

76 |

||||

| Landfill amortization, accretion and other related expense |

$ |

174 |

$ |

178 |

$ |

510 |

$ |

516 |

||||

| (a) | The summary of free cash flow has been prepared to highlight and facilitate understanding of the principal cash flow elements. Free cash flow is not a measure of financial performance under generally accepted accounting principles and is not intended to replace the consolidated statement of cash flows that was prepared in accordance with generally accepted accounting principles. | |||||||||||

| (b) | Represents amounts associated with business acquisitions consummated during the applicable period except where noted. | |||||||||||

|

|

||||||||||||||||||

|

RECONCILIATION OF CERTAIN NON-GAAP MEASURES |

||||||||||||||||||

|

(In Millions, Except Per Share Amounts) |

||||||||||||||||||

|

(Unaudited) |

||||||||||||||||||

| Three Months Ended |

||||||||||||||||||

| Income from Operations |

Pre-tax Income |

Tax Expense |

Net Income (a) |

Diluted Per Share Amount |

||||||||||||||

| As reported amounts |

$ |

680 |

$ |

516 |

$ |

126 |

$ |

390 |

$ |

0.92 |

||||||||

| Adjustments: | ||||||||||||||||||

| Loss on extinguishment of debt |

|

- |

|

52 |

|

13 |

|

39 |

||||||||||

| Advanced Disposal transaction and advisory costs |

|

21 |

|

21 |

|

1 |

|

20 |

||||||||||

| Non-cash impairments of assets and other |

|

14 |

|

14 |

|

3 |

|

11 |

||||||||||

| Enterprise resource planning system related costs |

|

6 |

|

6 |

|

1 |

|

5 |

||||||||||

|

|

41 |

|

93 |

|

18 |

|

75 |

|

0.17 |

|||||||||

| As adjusted amounts |

$ |

721 |

$ |

609 |

$ |

144 |

(b) |

$ |

465 |

$ |

1.09 |

|||||||

| Depreciation and amortization |

|

419 |

||||||||||||||||

| As adjusted operating EBITDA |

$ |

1,140 |

||||||||||||||||

| Three Months Ended |

||||||||||||||||||

| Income from Operations |

Pre-tax Income |

Tax Expense |

Net Income (a) |

Weighted Average Common Shares Outstanding |

Diluted Per Share Amount |

|||||||||||||

| As reported amounts |

$ |

734 |

$ |

615 |

$ |

120 |

$ |

495 |

|

427.4 |

$ |

1.16 |

||||||

| Adjustments in connection with pending acquisition of Advanced Disposal: | ||||||||||||||||||

| Transaction and advisory costs |

|

3 |

|

8 |

|

1 |

|

7 |

|

- |

|

0.02 |

||||||

| Impact of reduced common stock repurchases from planned levels |

|

- |

|

- |

|

- |

|

- |

|

(5.2) |

|

0.01 |

||||||

| As adjusted amounts |

$ |

737 |

$ |

623 |

$ |

121 |

(b) |

$ |

502 |

|

422.2 |

$ |

1.19 |

|||||

| Depreciation and amortization |

|

404 |

||||||||||||||||

| Adjusted operating EBITDA |

$ |

1,141 |

||||||||||||||||

| (a) | For purposes of this press release table, all references to "Net income" refer to the financial statement line item "Net income attributable to |

||||||||

| (b) | While the Company calculates its effective tax rate based on actual dollars, an approximate effective tax rate can be calculated by dividing the Tax Expense amount in the table above by the Pre-tax Income amount. The adjusted effective tax rate was 23.7% and 19.4% for the quarter ended |

||||||||

|

|

|||||||||||

|

RECONCILIATION OF CERTAIN NON-GAAP MEASURES |

|||||||||||

|

(In Millions) |

|||||||||||

|

(Unaudited) |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Three Months Ended |

|||||||||

|

|

|

|

|

|

|||||||

| Adjusted SG&A Expenses and Adjusted SG&A Expenses Margin | Amount | As a % of Revenues |

Amount | As a % of Revenues |

|||||||

| Operating revenues, as reported |

$ |

3,861 |

$ |

3,967 |

|||||||

| SG&A expenses, as reported |

$ |

416 |

|

10.8% |

$ |

386 |

9.7% |

||||

| Adjustments: | |||||||||||

| Advanced Disposal transaction and advisory costs |

|

(21) |

|

(3) |

|||||||

| Enterprise resource planning system related costs |

|

(6) |

|

- |

|||||||

| Adjusted SG&A expenses |

$ |

389 |

|

10.1% |

$ |

383 |

9.7% |

||||

| 2020 Projected Free Cash Flow Reconciliation (a) | |||||||||||

|

Scenario 1 |

Scenario 2 |

||||||||||

| Net cash provided by operating activities (b) |

$ |

3,500 |

$ |

3,600 |

|||||||

| Capital expenditures |

|

(1,600) |

|

(1,650) |

|||||||

| Proceeds from divestitures of businesses and other assets (net of cash divested) (b) |

|

25 |

|

35 |

|||||||

| Free cash flow (b) |

$ |

1,925 |

$ |

1,985 |

|||||||

| Advanced Disposal transaction and advisory costs |

|

100 |

|

115 |

|||||||

| Free cash flow (excl. Advanced Disposal transaction and advisory costs) |

$ |

2,025 |

$ |

2,100 |

|||||||

| (a) | The reconciliation includes two scenarios that illustrate our projected free cash flow range for 2020. The amounts used in the reconciliation are subject to many variables, some of which are not under our control and, therefore, may not be indicative of actual results. The Company's 2020 guidance excludes (i) post-closing financial contributions from the acquisition of Advanced Disposal and (ii) the after-tax proceeds from the divestiture of Advanced Disposal and Waste Management assets required by the |

|||||||

| (b) | We and Advanced Disposal entered into a Divestiture Agreement that provided for GFL Environmental Inc. to acquire a combination of assets from us and Advanced Disposal to address divestitures required by the |

|||||||

Analysts

713.265.1656

eegl@wm.com

Media

602.579.6152

jmicelli@wm.com

Source:

Sign up to receive our free Weekly News Bulletin